Excelsior’s Week In Review – Episode 3 – Will There Be A Hangover After The Fed Pivot Party?

Over this last week I crossed the country to spend some quality time visiting with my family and dear friends in a pre-holiday celebration. This allowed for festivities and cheer in front of the holiday week to follow; (without having to deal with the hectic international airports and cram-packed interstates surely on tap for this week to come). Synchronistically, last week’s market jubilance extended into a further Santa Claus rally, after the perceived dovish Fed “Pivot Party” got underway.

All of this stemmed from Jerome Powell’s comments in the press conference after the 2-day FOMC meeting mid-week. Markets intuited renewed expectations of an economic soft-landing, imminent rate cuts in the near future, and of good tidings to come for 2024. This Pivot Party was fueled by a mix of surprise by some, but a celebration and confirmation of the coming policy by the central bank to others. Some economists were clearly not expecting such a complete reversal of messaging out of Powell at this meeting, especially after his public addresses just a few weeks prior; and were thus caught off guard at the prospects of an earlier pivot than messaged. Conversely, the recent pivot talk was received as an inevitable validation by others, that had been anticipating monetary loosening policies to begin in earnest in the first half of next year.

This was definitely the inescapable topic du jour all of last week. For this reason, we’ll spend the first part of the macro-movers part section in this week-in-review, diving under the hood on a few of the other key takeaways. We’ll parse some economic data points that may support or conflict with the markets ebullient outlook. Additionally, we’ll dissect some comments from other Fed officials at the end of last week that stand in stark contrast to Powell’s press conference remarks. Buckle in, as this market sleigh ride might get a little bumpy…

Fedspectations Abound

Concluding the December Federal Open Market Committee meeting, the central bank kept the Fed funds rate steady in the 5.25%-5.50% range. The shift in outlook and sentiment was tied to expectations of the easing of monetary policy next year. Fed officials’ forecasts are now pricing in 0.75% in cuts in 2024, possibly over three different meetings, which would leave the policy rate in the 4.50%-4.75% range by the end of next year. Fed fund futures and even Goldman Sachs believe we’ll see more loosening and they are starting to price in cuts as soon as March next year. They are forecasting cuts totaling as much as 1.5% (150 basis points) next year, but with a higher percentage confidence for the second quarter and thereafter. Money markets are currently pricing in a 50% chance of a first, 25-basis-point rate cut in March, followed by successive reductions at every meeting through December.

At Wednesday’s press conference, what seemed to really animate the animal spirits of the markets were comments from Jerome Powell, where he had shifted his messaging and tone from the prior FOMC meeting. Even just two weeks ago, Fed Chair Jerome Powell definitively stated that “it would be premature to… speculate on when policy might ease.” What startled folks was that this last week he appeared to have completely pivoted in messaging with regards to keeping rates higher for longer, and acknowledged “the question of when will it become appropriate to begin dialing back the amount of policy restraint in place, that begins to come into view, and is clearly a topic of discussion out in the world and also a discussion for us at our meeting today.”

After these mid-week remarks from Powell, investors on the sidelines piled back into markets across the board in a risk-on speculative surge. It was game on! Forecasts continued to roll in with future expectations of imminent central bank rate cuts as soon as the first quarter of next year, and the eventual gift-wrapped monetary loosening to come. Yes, easy-money policies were now back on the table, and markets were juiced up even higher, punch drunk on speculative momentum (with dreams of central bank confetti raining down on markets and sugar-plum fairies dancing in their heads).

On Wednesday and Thursday, most financial news outlets emphasized those comments from the Fed head, and concluded that obviously good times and looser monetary policies were here again. Mainstream financial media outlets poured out articles and editorials, at the end of last week, that all but popped the champagne corks and broke out the festive hats on the back of this Powell Pivot Party. However, the question remains: Is the Fed pivoting too early here, based on the economic backdrop?

While markets last week clearly celebrated the pivot in Fed messaging, and the continuation of the strong seasonal “Santa Claus rally”; all of this does have me wondering…

- Will there be a nasty hangover after this Fed “pivot party” has run out of steam?

Markets are forward looking, but they often have the tendency of getting out over their skis. Often there are several false moves based on macro movers, and with something as talked about and repeatedly forecasted as when we’d see a Powell Pivot, this may just be more of the same that we’ve seen the last 2 years.

There are still a lot of unknowns going into next year, and as retail money comes in off the sidelines, and Johnny-come-lately funds try to do some year end book-squaring and move from cash to market positions. All of these mantras that good times are here again, does have some more discerning investors wondering, if this isn’t a “max pain” event? Could all the momentum traders or investors cowering in cash, that are now dog-piling back into the markets, a contrarian signal right before the next corrective flush to the downside?

A long-time guest and friend of the KE Report, Matt Geiger made this exact point when we asked him about the recent speculative fervor in the general equities in this last weekend show interview. Matt raises some good points and recommends caution on the back of this latest market euphoria.

To that end, when mulling over the potential of a Pivot Party hangover and a market buzzkill, we may have just seen the Grinch trying to steal Christmas… New York Federal Reserve President John Williams came out on Friday, in an interview on CNBC, vocally pushing back against the prevailing financial narrative and market optimism for imminent rate cuts.

Williams comments dashed investors dreams of central bank loosening by stating that, “We aren’t really talking about rate cuts right now.” In response to all the scuttlebutt around lowering rates, he stated “I just think it’s just premature to be even thinking about that.” The takeaway from William’s remarks were that the central bank continues to be data dependent and review whether monetary policy is in the right place to help guide inflation back to its 2% target. He also reiterated that the central bank could still tighten policy if needed. Well, that went over about as exciting as a lead balloon.

Even the usual asleep-at-the-wheel market commentators on the mainstream financial media outlets noted this 180 degrees different messaging from Williams’ press appearance just 2 days after Powell’s presser. Talk about the Fed sending mixed messaging… Most outlets noted that this sure seemed like an attempt to reframe the message that markets took from Powell’s comments, to engineer a tone change, and downplay the expectations of a pivot with regards to dialing back the policy restraint.

Evercore ISI analysts summed it up well, with regards to the interview with John Williams’, stating it “intended to lean against speculation on a March cut without ruling it out, and slow the sense in markets of a Fed rush towards cutting following Powell’s very dovish December press conference. Deploying the N.Y. Fed president in this manner is standard practice when the Fed leadership wants to ‘clarify’ the message, but market pricing moved only modestly in response to his comments, reflecting investor conviction that the data is moving in support of earlier/deeper cuts.”

Regardless, this caused general equities, cryptos, and gold to reverse back down lower during the trading session on Friday, while the US dollar reclaimed some ground to the upside. While this caused some investors to pullback speculations on U.S. interest-rate reductions next year, in general, market sentiment remains generally positive. It will be important to see how markets respond this next week, based on the indecision and reversal in messaging we saw to end last week, but most analysts we talked to expect to see more upside momentum.

On our podcast show this last week we interviewed Joel Elconin, Co-Host of he Benzinga PreMarket Prep show, and he reiterated the jubilation and momentum seen in the markets; which he expects to continue. Joel also noted that with markets near all time-highs, we could see a sustained breakout to the upside, and noted it was “nirvana here in the markets.” Here is a link to that interview for those that may have missed it.

https://www.kereport.com/2023/12/17/joel-elconin-dont-fight-the-bull-market-thanks-fed-pivot/

It remains to be seen what kind of legs these recent market moves may have, and if the small cap stocks in the iShares Russell 2000 ETF (IWM) can continue to rally, improving the market breadth under the surface. The Magnificent 7 mega-cap tech stocks remain quite buoyant, cryptocurrencies have surged in tandem, and most every sector was green on the screen for last week. However, there were some editorials issued over the weekend, expressing some doubts about the durability of this rally all falling on the back of just this central bank pivot in messaging only, from monetary tightening to monetary loosening. The question remains as to what catalysts can keep propelling markets higher to the upside?

Over the years, I’ve made it clear in my writings and vocally in interviews with guests on our show at the KE Report, that it is much more germane to focus on what the Fed actually does, versus what they actually message. This remains a key consideration in all the wake of this Fedspeak. It is very much the same thing one needs to keep in mind when tracking OPEC+ in the oil patch; with regards to what they say versus what they actually do. Look, there have been a multitude of times that the Fed has completely flip-flopped on what they actually did for policy, and when they actually did it, compared to how they had messaged to the markets.

History has demonstrated over and over again that the Fed often acts somewhere in the midpoint of all their polarizing interview comments from various members, but never quite exactly when the masses expect it on the timeline. Even last week, there was a case to be made that there was one Fed voice that presented a more reserved and slower middle path; one that seems quite viable for consideration.

While John Williams comments stole the show and media attention on Friday, he overshadowed an interview on Reuters later that day with Atlanta Fed President Raphael Bostic. I felt his lessor-followed comments were worth highlighting again in this weekend’s missive. Raphael was more dismissive of the early 2024 rate hike policy reality that the market is currently betting on, and was forecasting the possibility of the first rate cut out into the third quarter of next year. Bostic projected that inflation would end next year at around 2.4%, as measured by the personal consumption expenditures price index, and that this would be enough of a move towards the Fed’s 2% target to warrant two 25 basis-point rate cuts during the second half of 2024. This remains to be seen, as does if the inflation metrics can even get back down to 2% next year, but it was an interesting admission that getting most of the way there may just be good enough.

When Bostic was asked about monetary easing in the year to come, he acknowledged it would happen but remarked, “I’m not really feeling that this is an imminent thing.” He seemed steadfast in his belief that central bank officials and policymakers would still need “several months” to continue collecting inflation data, and confirm that its’ decline lower is sticking, before departing from the current Fed funds rate of 5.5%.

I think this messaging from Bostic, is that “middle path” with regards to the central bank messaging, and could represent the reality the market fails to see through their current rose-colored glasses. Yes, rate hikes are coming, but it is quite possible that it isn’t an “imminent thing,” and that this recent rally in general equities is getting a bit ahead of itself on the prospects of a pivot. One thing is for sure… If we are going to see the central bank start cutting rates, it will need to be on the back of economic data that is getting much weaker, a labor market that is eroding, and something bigger breaking in the financial sector. We don’t see that definitively in the data yet, but the next few months of economic reports back to the market are going to be key to sussing out if the economy is starting to contract in a bigger way, and possibly heading into the most foreshadowed and expected recession of all time.

While inflation still seems to be a macroeconomic indicator on the top of the central bank members minds, it was also poignant that Chicago Fed President Austan Goolsbee, in an interview with the Wall Street Journal last week, said it is increasingly likely the central bank will need to shift its attention from inflation to employment, the other part of its dual mandate. He also told the newspaper that “he wouldn’t rule out a rate cut in March.” That seemed to echo the markets interest in the trends in the NFP jobs reports, and subsequent revisions lower, along with the expectations for hike in Q1 of next year.

This takes us back to comments from John Williams though, when considering the health of the economy, “the base case is looking pretty good: Inflation is coming down, the economy remains strong and unemployment is low.” That said, “one thing we’ve learned, even over the past year, is that the data can move in surprising ways,” he said, adding “we need to be ready to move further if inflation, the progress of inflation were to stall or reverse.”

While both Powell and Williams reiterated on bringing inflation down to its 2% target, even after most participants seemed sufficiently satiated with the continued pattern of decelerating inflation trends seen in the CPI data released last week. The inflation gauge that measures price changes for a basket of goods and services ticked down slightly to 3.1% for the 12 months that ended in November, according to Bureau of Labor Statistics data released Tuesday. Both central bankers and market participants are recognizing that inflation is stubbornly coming down over time.

One more comment from Powell from last Wednesday’s press conference of note, was where he seemed to put more of a focus on the labor markets, and reminded himself and markets that the Federal Reserve actually has two mandates: inflation and unemployment. For most of 2022 and 2023 the Fed has acted as if only their first mandate of inflation ultimately mattered, with one of the most extreme raising of interest rates we’ve seen in decades. Throughout this aggressive rate hiking cycle they had to know this policy was risking bringing on economic recession. This week Powell also stated, “You’re getting now back to the point where both mandates are important. We’ll be very much keeping that in mind as we make policy going forward.”

It seems clear that while inflation will remain a key input on their radar, that they also have a pivot in focus moving into 2024, that is going to be much more about jobs data trends, and the health of businesses and the economy at large. From all reports coming in the U.S. consumers are still spending, as evidenced by the continued strong retail sales data, and even the stronger-than-expected report out last Thursday. However, looking back to Q3 earnings reports, many retailers warned that Q4 may be softer than analyst expectations and many companies saw muted demand heading into the beginning of next year. If all the reports coming in about record credit card debt, US families savings mostly depleted, and home equity lines of credit mostly tapped out at this point, then it does cause one to have pause about where all the consumer buying is supposedly going to come from in the new year.

Overall though, up until present, the consensus on Wall Street is that the economy and labor markets are still growing robustly. Most economists and analysts seem to agree that we’ll keep seeing growth and a strong jobs markets, but with the caveat that those very conditions could spike the punchbowl again with regards to inflation. If inflation was to start ticking back up higher, then how would that change the calculus with regards to the expected coming rate hikes? It’s a question worth consideration.

Bottom line:

There still is the obvious disconnect in what we’ve witnessed the last 2 months and even over the last week in the markets big sugar-high rally on expectations for imminent rate cuts next year, and the economic reality and contraction that would cause the Fed to cut rates in the first place.

What is strange in this current market cycle, is that if speculators are considering more rate hikes for 2024, then they seem to be shrugging off the accompanying economic pain that would pair with these rate hikes. If we are moving into an economic contraction or even a recession, then how well are most companies actually set up for weathering that storm? What will happen to consumer demand and earnings in that environment?

Obviously for Powell to have finally verbally pivoted to changing from monetary tightening to monetary loosening, then that begs the question of: “What are they seeing in the data that we don’t know?” Clearly there is something in the data that concerns them, if they leave policies to restrictive and some collateral damage from “higher rates for longer.” As we move into next year, this key point seems lost on most market watchers, as they blindly buy the dip and continue levitating in bull market nirvana.

A Look At Look At The Global Economy Continuing To Wobble:

There are also other developments on the global stage and economic reasons to warrant some caution moving forward. For instance, the European Central Bank and Bank of England don’t appear to be nearly as willing to follow the Fed’s pivot to cutting rates anytime soon. In fact, Norway’s central bank actually just raised rates on Thursday. Additionally, this coming week there is the much anticipated Bank of Japan policy meeting, and their monetary policy and changing views on yield curve controls have been one of the biggest wildcards of this whole year. Of course, China also remains on most investors mind for how they are going to continue to emerge with a very mixed bag of areas of growth and areas of their economy that are totally unraveling. There will be more to discuss on this in future editorials, for the near term, the focus of last week and this week has been on Europe.

Many market speculators and future’s traders placed bets last week that the European Central Bank would follow in the Fed’s footsteps, and hint at aggressive rate cuts next year, but so far that has not been the messaging from Europe’s central bank. In all reality, the recent pivot from the Fed’s messaging has put Europe’s central bankers in a bind. Christine Lagarde, the ECB president, spent much of her recent news conference doing damage control on market expectation for interest rate cuts, and fending off these hopes, pointing to a deepening downturn in business activity and that they may be flirting with the early-stages of recession already.

In the currency markets last week, the Euro and Pound Sterling were supported by the ECP and BOE holding steady, with bank heads pushing back on speculators in the futures markets dreams of coming rate cuts. The messaging has remained that they need to be more economic data dependent than time dependent, and public commentary from ECB governors circulating on Friday suggested they were of the same mind, and in no rush to cut rates imminently. European Central Bank policymakers do not expect to change their message to the markets on their need for high interest rates before their next policy meeting on March 7th meeting, making any rate cut before June dubious.

In reality, the ECB has more scope than most countries to ease, according to an interview last week with Pepperstone strategist Chris Weston, given their low Euro-zone growth and faster pullback in inflation on percentage terms. Weston went on to note, “However, the pushback from (ECB President) Lagarde and co suggests conjecture on the timing of initial easing – perhaps this is a function that it’s desirable to keep one’s currency strong to limit imported inflation.”

With regards to the Bank Of Japan: The BOJ is the last of the major central banks to meet in December and close up 2023, with the key question for investors being: Will the BOJ message that is scrapping its policy of keeping interest rates buried in the basement, or will they let them rise?

Checking In On Other Markets:

Interest Rates:

As a general theme, US Treasury yields ratcheted down past multi-month lows last week, with the 10-year yield diving down below 4% and falling over a point from it’s 5% yield just over 2 months ago. The 2-year yield was down about 40 points on by the end of the week; however the yields did get a bounce on Friday once some of the more hawkish Fed heads like Williams and Bostic threw a wet blanket on the ignition of the markets seen on Wednesday and Thursday. This has been one of the bigger departures from the trends investors have been watching thus far in 2023, where the norm has been the steady climb higher in interest rates, up through their peak rates in mid-October.

As mentioned last week, it still shouldn’t be understated that the bond yield curve remains stubbornly inverted, with higher rates at the short end of the curve, and the 2-year yield consistently higher than the widely-followed 10-year yield. While this inversion is quite abnormal on a longer-term historical basis, it has become something investors for over a year now have become nonplussed about, and apparently desensitized to as simply the new normal. However, this will come to an end. When the yield curve inevitably does flatten back out and normalizes with higher yields back at the longer end of the curve, then that is often a signal that indicates a recession is more imminently at hand. We clearly haven’t seen that yet, but it will be something to keep our eyes on moving forward.

A good way for investors to trade the trends in interest rates is using the (TNX) CBOE US 10-Year Treasury Yield Index. One can see that after a solid year of moving higher, this index topped out near $50 in mid-October along with interest rates, and this last week it actually pulled down below the 200 day exponential moving average (currently around $41), before bottoming at $38.85 and then bouncing up higher on Friday to close at $39.60. It will be key to see if that $38.85 low from last week holds this week, and more importantly, if the TNX can break back up above that 200 day EMA. Right now the trend remains bearish until something changes.

US Dollar:

The greenback dropped last week around 3% against a basket of world currencies, registering one it’s largest weekly drops fueled even lower on the back of the dovish Fed pivot messaging, and pushback on imminent rate cuts from the ECB and BOE in the Eurozone. However, the US dollar did start to rally on Friday closing at $102.24, again, on the back of other Fed-heads pushing back the timeline on the coming rate cuts.

After the US Dollar has been such a rollercoaster the last few years. After surging from the 89 level in early 2021 it screamed up higher to a peak of 114.75 in September of 2022. Since that highwater mark, the USD has been falling and has generally been in a downward trend. However, we did see another counter-trend rally kick off this last summer where it bottomed at 99.22 and then double-topped in early October and again in early November around the 106.70-107 level. Since then, the greenback has again resumed it’s downward trajectory, and has been in declined for the last 7 weeks. How high the dollar goes will be due to a confluence of factors from technical levels, to patterns in US treasuries, and also global moves in the 6 largest currencies in the basket weighted against the dollar in the index. Again, the greenback remains a key market to follow for investors, as not only the world’s reserve currency, but also a key number in high-frequency trading algos.

General US Equities:

Even though the markets retreated a bit on Friday, for all the reasons aforementioned in this article, the Dow had climbed to a fresh all-time high on Thursday, and the S&P 500 and Nasdaq made new 2023 highs (eclipsing their prior summer peaks). The main Wall Street indices put in their seventh-consecutive positive week, marking the S&P 500’s longest streak of weekly gains since September 2017, and the Dow’s longest since early 2019. Those moves in the broader averages were quite significant for the technical setup, and played into the improving sentiment and optimism on the street.

The S&P 500 remained right on the cusp of a new record high, up over 12% just since it’s October lows, following the Powell’s mid-week pivot comments and somewhat more dovish forecast on interest rates. However, as mentioned earlier in this missive, there are some market watchers that are questioning the durability of the rally based mostly on Fedspectations, cheaper corporate and consumer borrowing rates in 2024, and the soft-landing narrative. The other factor playing into the market moves since early November has been the decelerating inflation trend, which gave the Fed the leeway to start talking about a future pivot, and this brings the Fed outlook more in harmony with positions in already reflected in the Fed funds futures markets.

With the Dow and Nasdaq indexes finally breaking to new highs last week, investors this week will be looking to see follow-through buying to the upside to keep the rally going, and if the (SPX) S&P 500 large cap index can also break to a new higher above the current all-time high of $4818.62. The SPX did get within roughly $50 of this all-time high on Thursday, but then lost some ground correcting some on Friday to close the week at $4744.21. All eyes are on that prize in the week to come.

Commodities:

Oil and energy stocks finally got a bounce last week, with WTI popping up into the mid $72s on Thursday and Friday, and some energy pundits believe we’ve now seen the lows in the energy patch for the intermediate term. It is quite probable that we saw a turn in the key energy stocks EFT (XLE) Energy Select Sector SPDR Fund last week, after remaining under pressure for most of Q4. (XLE) had double-topped at $93 in September, and again at $92.56 in October, and since then has pulled back down for the last few month. However, last week’s action had pricing blast back up through the 200 day Exponential Moving Average (currently at $83.35), and interestingly through both the 50 day EMA at $84.17, and the 50 day Simple Moving Average at $84.72, to close the week at $84.73. This was pretty bullish action in the XLE and energy stocks, and we’ll be watching this next week to see if can maintain this upward momentum.

Most of the analysts we’ve brought onto the KE Report still see oil and the energy stocks remaining under pressure in the near to medium term, including longtime friend and guest on our podcast show Richard “Doc” Postma. Last week we recorded one of our trading segments together where we discussed a gold stock, a silver stock, a precious metals royalty stock, and a nat gas stock. Doc had some interesting technical thoughts on the natural gas and oil sectors worth consideration, so here is a link to that interview and a number of the charts we discussed for those that missed that conversation.

Copper has continued to trudge along in a sideways range, and aside from a few nice moves higher well above $4 at the beginning of the year, the red metal has been basically stuck between $3.50 – $4.00 most of the rest of this year. Since “Doctor Copper” is seen as a barometer for economic growth, it’s muted moves and inability to break out may signal some investors concerns about the strength of not just the US but also the global the economy and potential worries of a recessions in many nations heading into next year.

While many resource investing pundits have been table-pounding uber-bullish on the copper narrative for several years now, I’ve just not seen anything personally on the technical pricing action that had me very excited about copper or the copper junior resource stocks as a general group for the better part of the last 2 years. Sure, there have been a very few isolated discovery stories of note, but those are exceptions, and otherwise this sector has been rather boring. If one wanted to play the copper stocks, they were far better off avoiding the vast majority of the juniors and focusing on the larger cap copper producers, which held up far better and some had some pretty good runs. It will be interesting to see if Copper can get back up to a solid $4 handle on pricing, or even back up above that $5 handle it glimpsed briefly right at the beginning of the Ukraine war starting when base metals really surged. However, if we are heading into a global economic contraction, it’s hard to envision where that demand would be coming from.

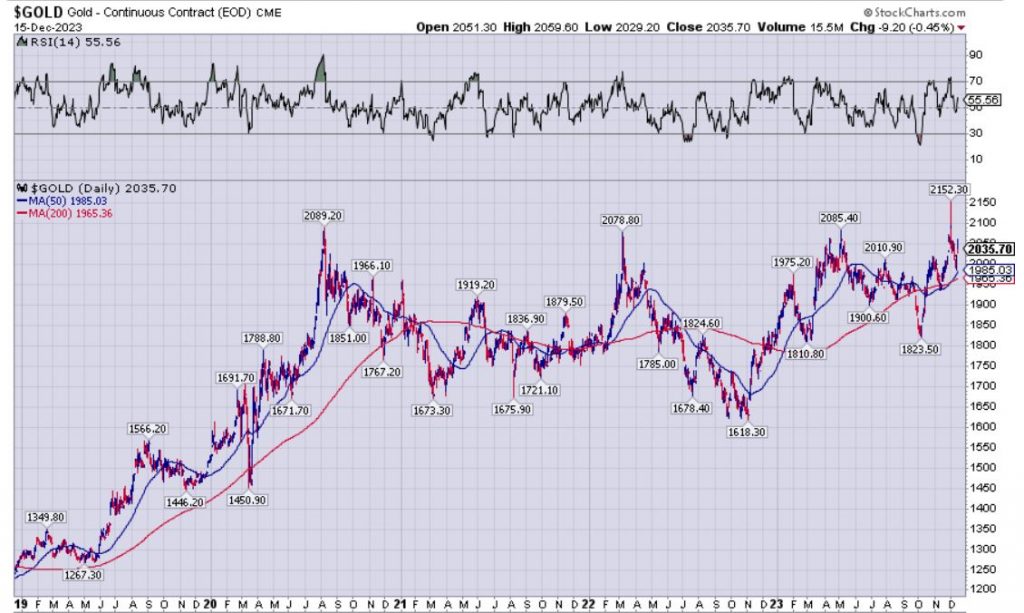

With regards to Gold, it pretty much channeled sideways last week, after going on it’s own rollercoaster ride the last few weeks. As noted in my first publication, the yellow monetary metal put in all-time monthly, weekly, and daily highs on the charts to end 3 weeks back, even scorching to an all-time high of $2152.30 on the futures markets in overseas trading. However, as mentioned in last week’s article, gold then pulled back violently that succeeding week diving down into the high $1980’s. Well, we followed up all that action the prior two weeks with a lackluster sideways grind for last week, but ending decisively higher than the carnage from the prior week to close things up on Friday at $2035.70. Even though it’s been a whipsaw market in gold, the overall trend and action has still been on the bullish side, and the bears have a lot more work to do if they want to break this strong pricing action.

On the KE Report ,we speak with a number of pundits and thought leaders in the sector on how they are viewing the larger set up in the precious metals sector, and how they are trading the gold and silver equities. The interview from last week that most stuck out in my mind as having some great kernels of wisdom in it for investors to consider was the discussion I had with long-time guest on the show John Rubino, where he shared the type of gold stocks he was acquiring or holding in his portfolio, considering all the volatility we’ve seen in the PM stocks and sector overall.

- Here is a link to that interview with John Rubino, for those that missed it:

Normally, I like to fit in some comments towards the end on investing opportunities that have my attention in the resource stocks, but I’m going to save that for a mid-week update, as this particular article is long enough at this point, and really was more focused on the larger macroeconomic side of the equation. We’ll dive into the microeconomic side of the individual companies and sectors within the commodity space in the next missive, so stay tuned for that later this week.

May your week in trading and in life be very prosperous, and if you haven’t subscribed to my substack page, please come over and do so as I’ll be periodically throwing out 1-2 other shorter articles mid-week as things come up.

https://excelsiorprosperity.substack.com/

Thanks for reading and Ever Upward!

Shad

It can go a bit higher short term but it’s not a new bull market. New highs should be seen as a perfect chance to get out.

Ex, I think you could write a new novel every week. You must have breezed through your university courses. Forget about the hangover I think I will have a hair of the dog. When I want to have some quality time, I always go to the Quality Inn! LOL! DT

Haha!! Thanks DT.

Yeah, this article got a bit lengthy, and I probably spent too long on it (several hours). I was out of pocket traveling most of last week in TN and even today, so I didn’t get to really post anything on the KER forum. Maybe it was pent up writing energy.

As for the university courses… it’s been 25 years since then, but talk about a hangover…

I’ll be back in the saddle again tomorrow in Seattle, and hope to be a bit more active again with the KER crew.

TSX-V still hasn’t filled its post-Fed gap but I’m guessing that it will. Either way it’s looking good, finally.

https://stockcharts.com/h-sc/ui?s=%24CDNX&p=D&yr=1&mn=5&dy=15&id=p03067348895&a=1385107328

Copper doesn’t have the “all clear” from me that gold and silver do but it’s getting there and is a buy in my book just not yet a strong buy. Like commodities in general it typically lags gold and silver at major lows like it did in 2020 and 2016 (as well as 2002-3) and is lagging this time but accumulating it and related now/soon makes sense.

https://stockcharts.com/h-sc/ui?s=%24COPPER&p=W&yr=3&mn=7&dy=22&id=p13159754144&a=1561065654

Great Job….. Ex great outline……… Hope you had some great times in TN…. folks in that state,.. are down to earth , for the most part.

Thanks OOTB. Yes, the Tennesseans were in good holiday cheer, but the greater Nashville area was teeming with people, and I’ve never seen the roads that clogged going everywhere. The population there has just exploded over the last 2 decades, and has even accelerated the last few years.

Nice to see the family and catch up with old friends for the holidays. Made it safely back home late last night, and I’m back at it here at the KER.

Cheers!

Really good stuff Ex. Flows like a beautiful river.

I was listening to a Lacy Hunt interview from Nov 8 with someone yesterday and not only did he sound totally disgusted with The Fed but he said no way out of Hard Landing. I tend to believe him more than main stream media as we went to the same Elementary School.

I should have a shot at being green today as the OTC or somebody painted the close after hours for Benton Resources at .05 when cad was .16. Screws up my total today which should open equivalent to cad. I put a bid in for .05 anyway.

Great Day. Up 5% on my Schwab account. However, after correcting the error resulting from the low closing cost of Benton Resources, I am only up $150. Some up, some down.

Much appreciated Lakedweller2.

Yeah, the consensus on Wall Street of the “soft landing” may be in for a rude awakening next year, once the higher for longer interest rates start hitting loans that roll over, and will likely continue to impact auto loans, home mortgages, and commercial real estate. Another business sector Peter Boockvar recently pointed to as in the hurt locker would be the restaurant niche. They usually borrow money to fund payroll/business improvement/sustaining capital and will get not just with higher loan rates, but also inflation, and a lack of workers. We may see a string of restaurants give up the ghost in the new year.

I’m still a bit amazed that rates were taken as high as they were without more financial breakage, but it’s a process and not an event… so we’ll see how these policies come home to roost in 2024.

Lacy Hunt runs the Wasatch-Hoisington US Treasury Fund. He indicated that they picked up some 14 year as he believes deflation is going to become a real issue and the refinancings are going to place added problems with paying interest on the roll overs. I may misunderstand a lot of what he saying but he thinks we are in for decades of bad times.

Yeah, it’s worthy of consideration that we could see a very extended period of time where markets and the economy grind lower and long dull ache scenario.

Markets Applaud Another ‘Powell Pivot’

Jesse Felder – The Felder Report (12/16/2023)

While everyone is throwing darts at all time highs, seriously hugging the upper bollinger bands, no one seemed to notice the New York Fed manufacturing index for DEC that came on on Friday ….at -14.5………….and I don’t think markets have got the lag effect memo……………or the kick in the butt that comes with the FED perhaps not even cutting once till July or August if inflation is sticky til then…………..VIX is pricing in no risk down here………We’ll soon see if this is truly the birth of a new bull market !!!